- Advanced Technologies

- AI Career Advantage Collection

- AI Skills Mastery 2026 Collection

- Apple Accessories

- Arts, Crafts & Hobbies

- Best-Sellers

- Black Friday Sale

- Business & Digital Skills

- Car Accessories

- Dating & Social Skills

- Denim

- 7FOR

- AGOLDE

- Antony Morato

- Armani Exchange

- Boss

- Brunello Cucinelli

- Calvin Klein Jeans

- Costume National

- Desigual

- Diesel

- Dolce & Gabbana

- Dsquared²

- Ermanno Scervino

- Fendi

- Gianni Lupo

- Guess Jeans

- Ichi

- Just Cavalli

- Lee

- Levi's

- Liu Jo

- Morgan De Toi

- Mother Denim

- Only

- Pepe Jeans

- Pinko

- Replay

- Tommy Hilfiger Jeans

- Valentino

- Vero Moda

- Digital Resources

- Beauty

- Car Buying & Ownership

- Cozy Feast Collection

- Electronics & Technology

- Emotional Intelligence

- Financial Education

- Home Styling & Organization

- Mindfulness

- Nutrition & Healthy Eating

- Parenting & Child Development

- Personal Style & Fashion

- Pet Lifestyle & Wellness

- Positive Thinking

- Productivity

- Recipes

- Self Confidence

- Sleep Improvement

- Stress Management & Relaxation

- Travel & Adventure

- Travel Planning

- Yoga & Mind-Body Practices

- Education & Learning

- Family & Home

- Family & Parenting

- Fashion

- Alexander McQueen

- Bags

- Bags & Wallets

- Balenciaga

- Belts

- Blazers

- Bottega Veneta

- Brunello Cucinelli

- Burberry

- Chanel

- Chloé

- Dior

- Dolce & Gabbana

- Dresses

- Etro

- Fendi

- Gucci

- Hats & Hair Accessories

- Jacquemus

- Jewelry

- Jil Sander

- Jimmy Choo

- Keychains

- Kiton

- Luggage

- Miu Miu

- Off-White

- Outerwear

- Prada

- Rick Owens

- Saint Laurent

- Scarves

- Shoe Accessories

- Socks & Tights

- Sunglasses

- The Row

- Tom Ford

- Valentino

- Valentino Garavani

- Vivienne Westwood

- Watches

- Fashion & Beauty

- Fashion Accessories

- Furniture

- Gadgets

- Health & Beauty

- Health & Wellness

- Home & Garden

- Home Supplies

- Kids & Babies

- Nike

- Online Business for Beginners

- Parenting Guides Collection

- Patio, Lawn & Garden

- Personal Growth

- Personal Growth & Wellness

- Pet Care

- Pet Supplies

- Pets

- Shoes

- Smart Home Living Guides

- Sport & Outdoors

- Super Deals

- TikTok Growth & Monetization Mastery

- Travel

- Wealth

- Wealth Building

- Budgeting & Saving

- Cryptocurrency Investing

- Debt Management

- Entrepreneurship & Business Growth

- Family Finance & Budgeting

- Financial Independence

- Financial Mindset & Psychology

- Financial Planning

- Frugal Living & Expense Hacks

- Goal Setting

- High-Income Skills

- Investing Basics

- Leadership

- Motivation

- Networking & Mentorship

- Passive Income Strategies

- Real Estate Investing

- Side Hustles

- Stock Market Investing

- Women’s Wellness & Lifestyle

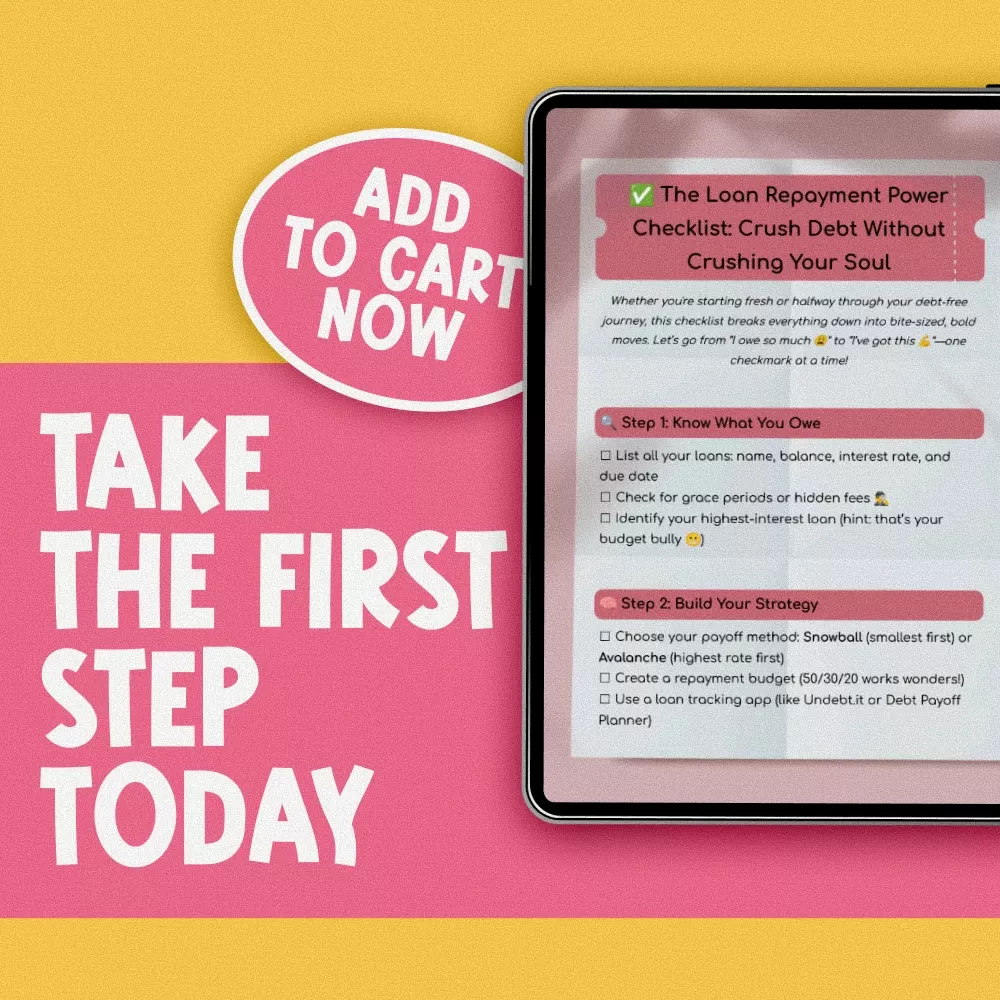

The Loan Repayment Power Checklist: Crush Debt Without Crushing Your Soul | Digital Download Guide for How to Manage Loan Repayments, Budgeting, Debt Freedom Plan, Financial Wellness

Designed in United States

Digital download

Digital file type(s): 1 PDF

Product Description

Take Control of Your Debt Without Losing Your Mind

If loan payments are draining your energy and hijacking your peace of mind, you’re not alone—and you don’t have to stay stuck. The Loan Repayment Power Checklist: Crush Debt Without Crushing Your Soul is your practical, no-fluff digital guide to finally conquering your loans and stepping into financial freedom. Whether you’re drowning in student debt, juggling credit cards, or just need a smart plan to stay ahead, this downloadable checklist turns overwhelm into action.

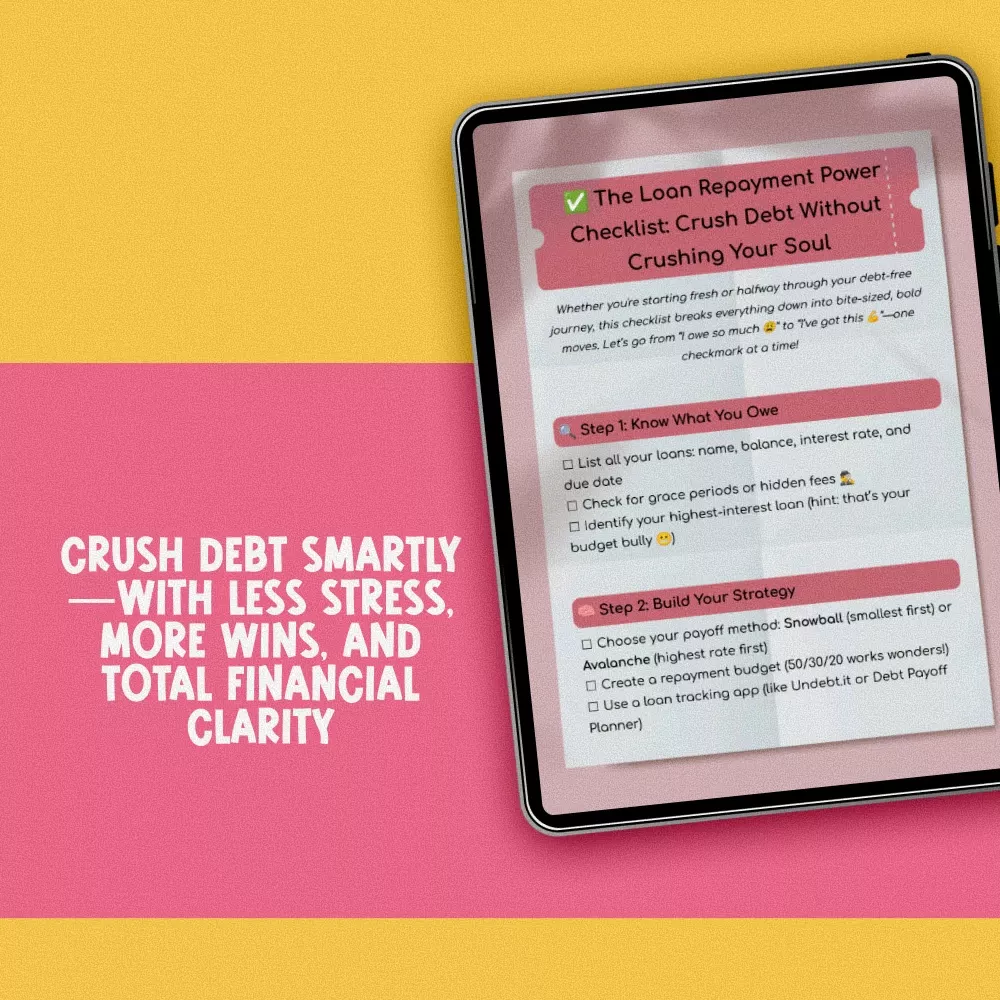

What’s Inside This Powerful Checklist?

- Step 1: Know What You Owe – Get clear on all your loans, balances, and those sneaky interest rates.

- Step 2: Build Your Strategy – Choose the right repayment method and budgeting formula (hello, 50/30/20!).

- Step 3: Avoid the Traps – Automate your success, ditch new debt, and track progress like a boss.

- Step 4: Be Ready for Curveballs – Learn what to do when life throws financial surprises.

- Step 5: Think Bigger, Live Freer – Shift your mindset, celebrate wins, and plan for a debt-free future.

Why You’ll Love It

- Clear and simple – No jargon, just actionable steps.

- Immediate download – Start managing your loans today.

- Budget-friendly focus – Includes how to manage loan repayments without cutting out all joy.

- Flexible – Whether you’re using the Snowball or Avalanche method, this guide works with your goals.

- Mindset matters – Encourages small wins, positive habits, and long-term success.

Who It’s For

This checklist is ideal for students, recent grads, young professionals, or anyone feeling overwhelmed by loans. If you’ve searched for how to manage loan repayments and want something you can actually use—this is it.

What Makes It Different?

Unlike generic debt guides, this isn’t a novel—it’s a clear, motivational checklist you’ll actually use. Designed for real life, this download blends practicality with mindset tools to help you stay on track emotionally and financially. You’re not just checking boxes—you’re building a better future.

Ready to Crush Your Debt (Without Crushing Your Soul)?

Download The Loan Repayment Power Checklist now and start turning your financial stress into real progress. Whether you’re just starting your journey or want a reset, this is your sign. Let’s go!

Refunds & Returns

Order cancellation

All orders can be cancelled until they are shipped. If your order has been paid and you need to make a change or cancel an order, you must contact us within 12 hours. Once the packaging and shipping process has started, it can no longer be cancelled.

Refunds

Your satisfaction is our #1 priority. Therefore, you can request a refund or reshipment for ordered products if:

- If you did not receive the product within the guaranteed time( 45 days not including 2-5 day processing) you can request a refund or a reshipment.

- If you received the wrong item you can request a refund or a reshipment.

- If you do not want the product you’ve received you may request a refund but you must return the item at your expense and the item must be unused.

We do not issue the refund if:

- Your order did not arrive due to factors within your control (i.e. providing the wrong shipping address)

- Your order did not arrive due to exceptional circumstances outside the control of Glacere (i.e. not cleared by customs, delayed by a natural disaster).

- Other exceptional circumstances outside the control of https://glacere.com

*You can submit refund requests within 15 days after the guaranteed period for delivery (45 days) has expired. You can do it by sending a message on Contact Us page

If you are approved for a refund, then your refund will be processed, and a credit will automatically be applied to your credit card or original method of payment, within 14 days.

Exchanges

If for any reason you would like to exchange your product, perhaps for a different size in clothing. You must contact us first and we will guide you through the steps.

Please do not send your purchase back to us unless we authorise you to do so.

Instant download

Your files will be available to download once payment is confirmed.

Customer Reviews

There are no reviews yet